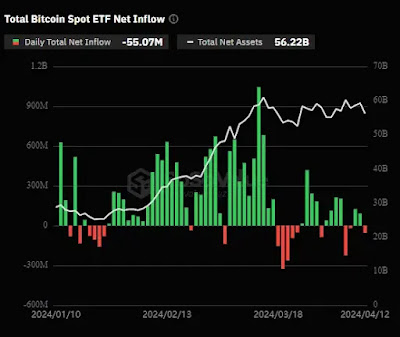

Spot Bitcoin ETFs, or exchange-traded funds, saw a net outflow of $55 million on Friday, April 12.

The data indicates a turnaround

following two days of roughly $215 million in inflows into ETFs.

Bitcoin ETFs ahead of halving

SoSo Value data shows that Grayscale's GBTC

experienced the biggest withdrawal on Friday, with $166 million taken out.

Prior to the halving, GBTC continues to witness

significant withdrawals; on Monday, April 8, the ETF lost $154.9 million.

On Friday, however, BlackRock IBIT saw the most inflow, drawing $111 million into the ETF.

The cryptocurrency market has clearly felt the

effects of Friday's withdrawal. In the last day, Bitcoin fell by about 5%,

reaching $65,000. The liquidation of roughly $900 million was followed by the

whole market.

Last week, there were three days of net outflows from Bitcoin ETFs, with $298.4 million in money leaving the market.

|

| Total spot Bitcoin ETF net inflow | Source: SoSo Value |

Michael Sonneshein, CEO of Grayscale, is upbeat despite the recent withdrawals from GBTC. Sonneshein has recently highlighted that it is likely that the withdrawals from GBTC have found equilibrium. He thinks that when Grayscale lowers the fees associated with its Bitcoin ETF, the outflow will dramatically diminish.

|

|

Another reason for the ongoing

withdrawals from the ETF market could be a pre-halving decline. It's widely

expected that the biggest cryptocurrency will see a bigger bull market

following the halving of its value. Thus, a pullback happens when investors

begin to take short-term profits and then reinvest when the market declines.

Though Marathon Digital previously

forecast that BTC has already achieved its top following the legalization of

ETFs earlier this year, it's also possible that investors are wary about the

halving failing to produce significant rallies like prior years.

No comments:

Post a Comment